Calculating Breakeven When You Dont Know Costs Per Unit

What is Suspension Even Analysis?

Intermission Fifty-fifty Analysis in economics, business, and price bookkeeping refers to the point in which full cost and full revenue are equal. A interruption even signal analysis is used to determine the number of units or dollars of acquirement needed to cover total costs (stock-still and variable costs ).

Image: CFI's Budgeting & Forecasting Course.

Formula for Break Fifty-fifty Assay

The formula for break even assay is as follows:

Break even quantity = Stock-still costs / (Sales price per unit – Variable cost per unit of measurement)

Where:

- Fixed costs are costs that practice not change with varying output (east.thousand., salary, hire, building machinery).

- Sales price per unit is the selling price (unit selling price) per unit of measurement.

- Variable cost per unit of measurement is the variable costs incurred to create a unit of measurement.

Information technology is besides helpful to note that sales toll per unit minus variable toll per unit is the contribution margin per unit. For example, if a book's selling price is $100 and its variable costs are $five to make the book, $95 is the contribution margin per unit and contributes to offsetting the fixed costs.

Instance of Break Even Analysis

Colin is the managerial accountant in accuse of Company A, which sells h2o bottles. He previously adamant that the fixed costs of Company A consist of belongings taxes, a charter, and executive salaries, which add together upward to $100,000. The variable toll associated with producing ane water bottle is $2 per unit of measurement. The water canteen is sold at a premium price of $12. To determine the break even point of Company A'due south premium water bottle:

Break even quantity = $100,000 / ($12 – $2) = 10,000

Therefore, given the fixed costs, variable costs, and selling cost of the water bottles, Company A would need to sell x,000 units of water bottles to break even.

Graphically Representing the Break Even Bespeak

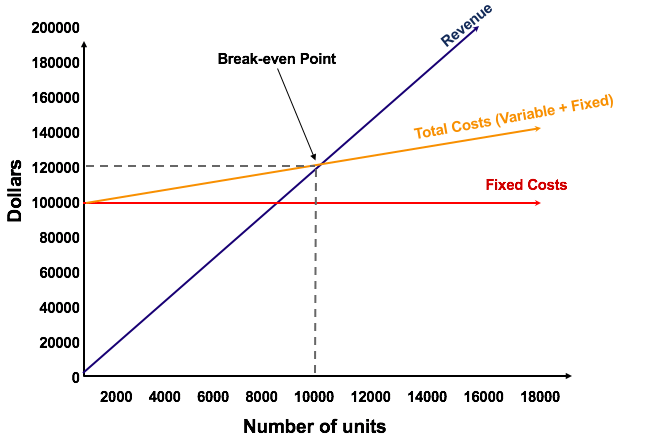

The graphical representation of unit sales and dollar sales needed to intermission fifty-fifty is referred to equally the break even nautical chart or Cost Volume Profit (CVP) graph. Below is the CVP graph of the example in a higher place:

Explanation:

- The number of units is on the X-centrality (horizontal) and the dollar corporeality is on the Y-axis (vertical).

- The red line represents the total stock-still costs of $100,000.

- The blue line represents revenue per unit sold. For example, selling ten,000 units would generate ten,000 x $12 = $120,000 in revenue.

- The yellowish line represents full costs (fixed and variable costs). For example, if the company sells 0 units, then the company would incur $0 in variable costs merely $100,000 in fixed costs for total costs of $100,000. If the company sells 10,000 units, the company would incur 10,000 ten $ii = $20,000 in variable costs and $100,000 in stock-still costs for total costs of $120,000.

- The break fifty-fifty indicate is at 10,000 units. At this point, revenue would be 10,000 10 $12 = $120,000 and costs would exist 10,000 x 2 = $20,000 in variable costs and $100,000 in fixed costs.

- When the number of units exceeds 10,000, the visitor would be making a profit on the units sold. Note that the bluish revenue line is greater than the yellow full costs line after ten,000 units are produced. Likewise, if the number of units is below 10,000, the company would be incurring a loss. From 0-ix,999 units, the full costs line is above the revenue line.

Download the Free Template

Enter your proper name and email in the form below and download the gratuitous template now!

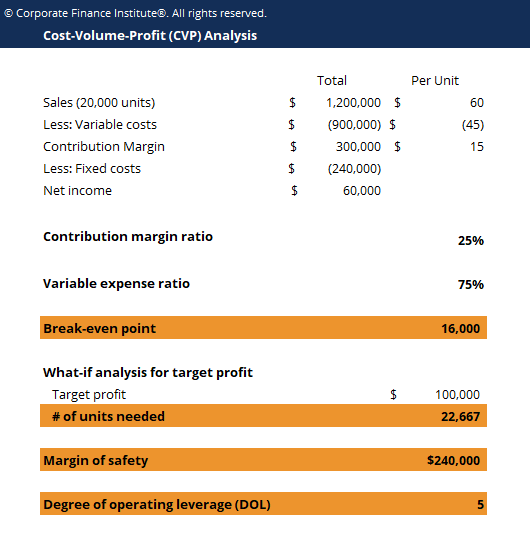

CVP Analysis Template

Download the free Excel template now to accelerate your finance knowledge!

Interpretation of Break Even Analysis

As illustrated in the graph above, the point at which full fixed and variable costs are equal to full revenues is known as the break fifty-fifty point. At the break even point, a business does non make a profit or loss. Therefore, the break even point is often referred to as the "no-profit" or "no-loss point."

The intermission even assay is important to business concern owners and managers in determining how many units (or revenues) are needed to cover stock-still and variable expenses of the business.

Therefore, the concept of break even bespeak is as follows:

- Turn a profit when Revenue > Total Variable cost + Total Fixed cost

- Break-even point when Acquirement = Total Variable price + Total Fixed cost

- Loss when Acquirement < Total Variable toll + Total Fixed toll

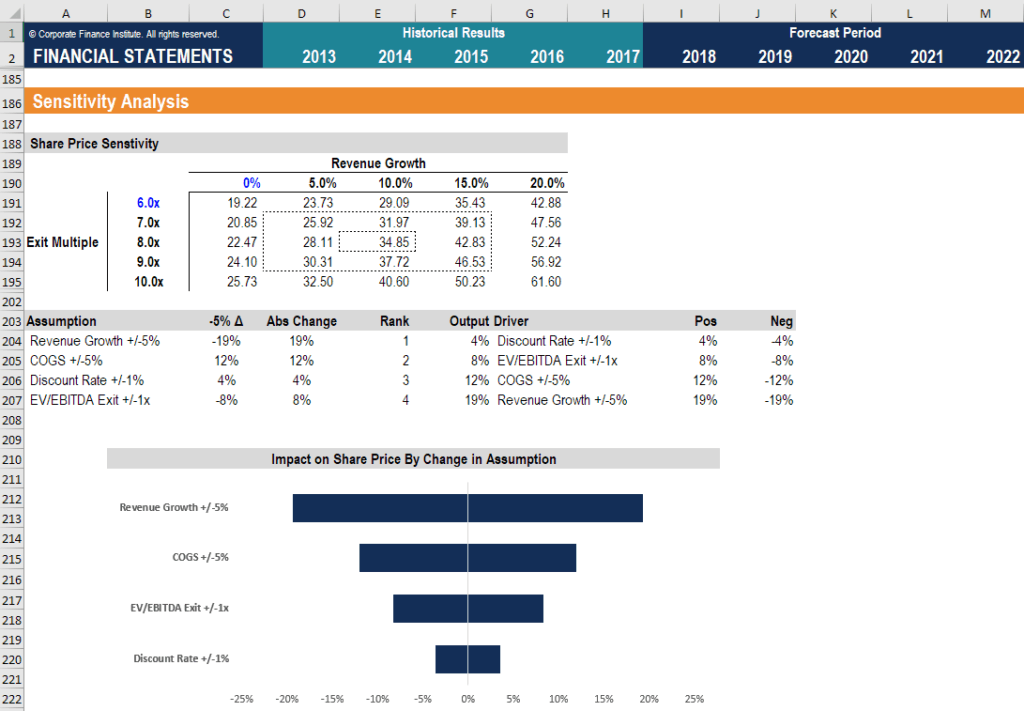

Sensitivity Analysis

Break even assay is ofttimes a component of sensitivity analysis and scenario assay performed in fiscal modeling . Using Goal Seek in Excel, an analyst can backsolve how many units need to be sold, at what price, and at what cost to break even.

Prototype: CFI's Financial Modeling Form .

Related Readings

CFI is a leading provider of financial analysis courses and financial analyst certification programs for investment banking, disinterestedness research, and financial planning and analysis (FP&A ) professionals. To help you advance your career, check out the additional CFI resources below:

- Price Book Turn a profit (CVP) Template

- How the 3 Financial Statements are Linked

- Cost Behavior Assay

- Analysis of Financial Statements

erlandsonnaal1948.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/modeling/break-even-analysis/

0 Response to "Calculating Breakeven When You Dont Know Costs Per Unit"

Post a Comment